How Digitisation is transforming Lending and Loan Management

Any consumer facing business is never far away from disruptions. The financial industry is one undergoing rapid upheavals. The way financial institutions and banks are lending money to their customers is now driven by digital systems and loan management softwares. Apart from the traditional financial institutions, there are numerous peer to peer lending platforms creating consumer centric solutions. Here we look at some of the changes that are creating a positive transformation in the lending industry:

1. Peer to peer lending :

The rise of digitisation has given way to online lending software. These platforms are built with consumer centric approach. The consumers can register on the platform and start applying for loans. The verification of the borrowers, eligibility documentation and credit score are calculated with transparency.

2. Faster Loan processing :

With a lending management system, the borrowers can submit documents with ease, check their own credit scores and also track the status of loans. The digital lending platform essentially automates the process and ensures compliance for the borrowers. The digital lending platform tracks and prompts borrowers to submit required documents and fast tracks the loan processing times.

3. Manage various Loans and Documents :

Managing various loans and documents for them can be quite cumbersome. With an online lending platform, the financial institution can specify the required mandatory documents and necessary fields for loans. For e.g. agricultural loans will have different required documents than commercial loans. The borrowers can choose the type of loan based on their needs, the platform then tracks the documents etc to complete the process.

4. Underwriting Proposals :

Creating underwriting proposals is a tedious task. The digital lending platform can create automated underwriting proposals based on the documents and mandatory information submitted by borrowers. The system automatically generates an underwriting report for the lender’s assessment of the risk, insurance value, loan particulars etc. The letter of intent, executive summary and underwriting proposals are all generated by the platform.

5. Multiple Lenders :

With lending software solutions, the financial institutions or private equity firms can have multiple lenders. The lenders can register themselves on the platform and set their criterion for loan disbursement, loan types, eligibility conditions and repayment terms etc. The lenders can also get to see the details of the borrower applications, documents etc on the platform & communicate with them.

6. Algorithmic for Best Fit :

The digital lending platform can have multiple lenders, borrowers and loan criterion. When a borrower loan application is submitted, the system matches it with the best fitting lender. For e.g. if the borrower has required income tax returns, good credit history and completed all eligibility documents, the lowest interest rate, best lending terms will be available. However for unsecured loans, higher interest rates may be applicable.

7. Collaterals and Agreements :

When the borrower application is processed, all required documents and collaterals for loan disbursement are also digitized. The digital document management ensures that the financial institutions can organise everything in an online repository and make the process seamless. The agreements between borrowers and lenders are available in their accounts along with other documents, collaterals etc.

8. Repayment Schedule :

The loan management software also tracks the status of repayments. When a borrower submits repayment, the loan particulars are updated on the platform. Automatic alerts and messages for repayments are sent to the borrowers. The repayment mode and schedule can be configured in the loan terms. It can be weekly, biweekly, monthly or quarterly as per the specified agreement terms.

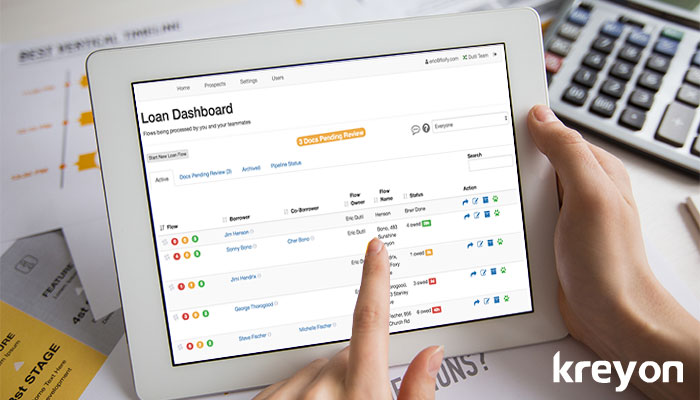

9. Monitoring & Administration :

The financial institutions can organise workflows, track pending action items and drive complete operations using digital lending platform. The platform can manage loan applications, lending agreements, payment collections, defaults, interest earned, etc. and summarise things according to preconfigured workflows. The system summarises key activity on the platform to make administration seamless.

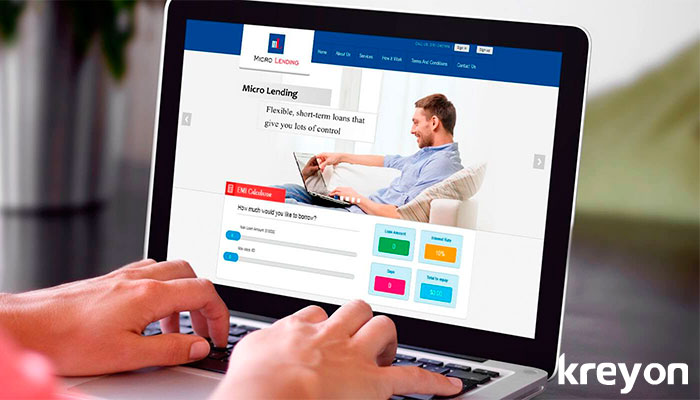

10. Customer Experience and Branding :

The leaders in any industry are prompt to understand the needs of their customers. The consumers are looking for ease and convenience in getting things done. The best financial institutions are eager to leverage digital solutions to improve their customer experience and offer them the best solutions.

Digitisation is causing many changes in the financial industry. Lending and borrowing is now seen as a digital service. The way loan applications are initiated, processed and serviced are changing with the digital platforms and software solutions. The on demand service economy is transforming financial institutions and lenders. Banks and finance companies are reimagining their products and services for the digital economy. The customers are the real beneficiaries of these changes.